Wear and Tear Fixed Asset Depreciation

This menu allows you to depreciate fixed asset for wear and tear. Click here to read more about wear and tear depreciation. Click here for more general information about fixed assets.

A list of all financial period with depreciable fixed assets is displayed. Click on the radio button for the period you want to depreciate. This will open a detailed report with information about the depreciation that will be done for each fixed asset.

To view depreciations that already have taken place click on the tab Already Depreciated Period. This lists all the periods were depreciations have been completed for all fixed assets.

Depreciation Detail Information Displayed

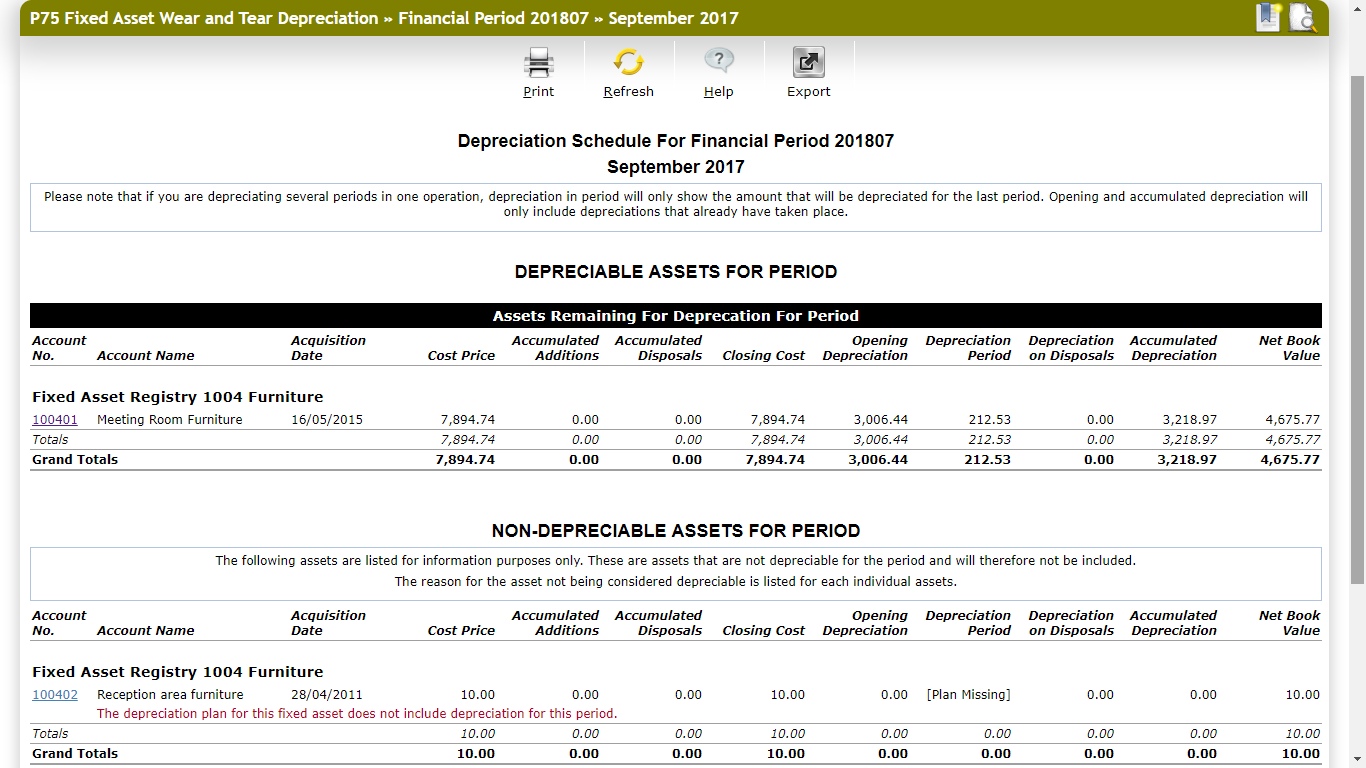

When a period has been selected a report displaying the details for each asset that will be depreciated is displayed.

The report is group by fixed asset registry. This means that each asset is listed under the register it belongs to and that the report is order primarily by register account number.

If everything is correct, click Depreciate Now to execute the depreciations. Otherwise, click Cancel, which will return you to the list of periods for depreciation.

Report Information Explanation

| Field | Do |

| Account Number |

Fixed asset account number

|

| Account Name |

Fixed asset account name |

Acquisition Date

|

The date the fixed asset was aquired.

|

| Cost Price |

This is the fixed assets cost price. It is the sum of all transactions on the fixed asset account up to and including the first depreciation period. |

| Accumulated Additions |

This is the additions on the fixed asset after the first depreciation period up to and including the depreciation period. The amount is the sum of all debit amounts on the fixed asset account less the except cost price. |

| Accumulated Disposals |

This is the disposals on the fixed asset after the first depreciation period up to and including the depreciation period. The amount is the sum of all credit amounts on the fixed asset account.

|

| Closing Cost |

This is the closing cost of the fixed asset at the time of depreciation. It is equal to cost price + additions - disposals. |

| Opening Depreciation |

This is the accumulated depreciations for the fixed assets up to the depreciation period. It includes regular depreciations and disposal depreciations up to the end of the depreciation period. In other words, it includes any depreciations that might have been done already on the period. |

| Depreciation Period |

This is the depreciation amount for the fixed asset in the depreciation period. This is the depreciation amount on the depreciation plan for the selected period. |

| Depreciation on Disposals |

This is the depreciation caused by disposal of the fixed asset up to and including the depreciation period. The amount is the sum of all debit amounts on the accumulated depreciation account. |

| Accumulated Depreciation |

This is the accumulated depreciation of the fixed asset at the after the deprecation in this period. It is equal to opening depreciation + depreciations in period + depreciations of disposals. |

| Net Book Value |

This is the net book value of the fixed asset at the after depreciation has been done. |